Key points of creation of journal entry through SLA:

There is a new functionality to enter subledger journals through SLA: Create Journal Entry page.

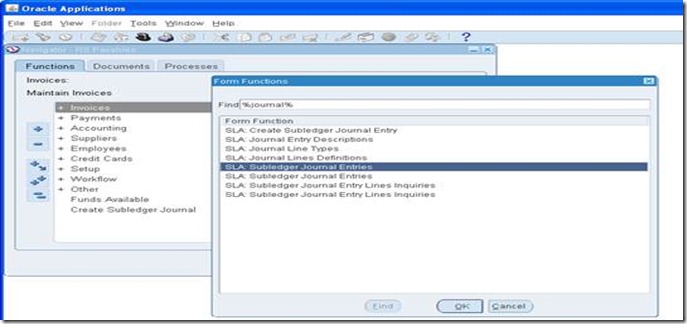

Add the function SLA: Create Subledger Journal Entry, if not available in relevant module. All the modules by default will have this function unless specifically restricted.

Very important point is manual subledger journal entry is not associated with transaction of any subledger application. Meaning we can’t transfer the entries to both Subledgers and GL without customization. This is true whether we use FAH or DRM (Data Relationship Management, which is part of Hyperion) applications.

If required to use Manual SLA Journals functionality to represent accounting treatment in legacy systems, one can use API which allows importing legacy transactions into SLA, change the accounting treatment as per Oracle EBS logic or combination and then transfer to GL.

SLA is a rule based accounting engine not a module, which sits in between Subledgers and GL. The entry that appears in SLA can be controlled or design using SLA rules. Therefore it is known as Rule based accounting engine.

Don’t use SLA: Debug% profile option, which is obsolete. Instead use profile options FND: Debug% for SLA to debug.

To transfer the subledger journal entries to GL from subledgers run the following programs

Very important this is the functionality of FAH where we will use API XLA_JOURNAL_ENTRIES_PUB_PKG to load the data into this create journal entry page (see the screen shot below). We don’t need license of FAH to use this package, however.

This is another way of loading the journal entries apart from GL_INTERFACE, Web ADI or manually entering the journals.

This is particularly useful to stream line the accounting string between Oracle EBS and Legacy or third party systems, which is the basic of FAH.

How it works:

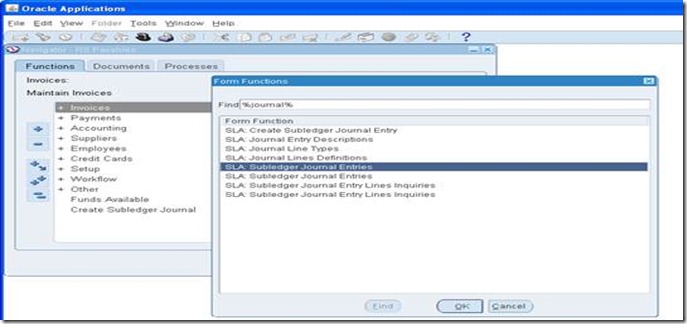

Go to Payable Module (any module can be used)

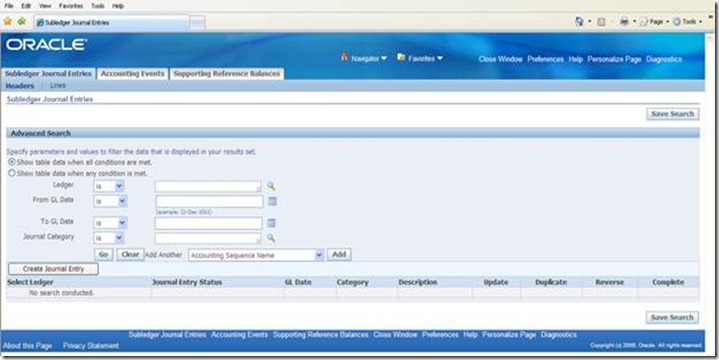

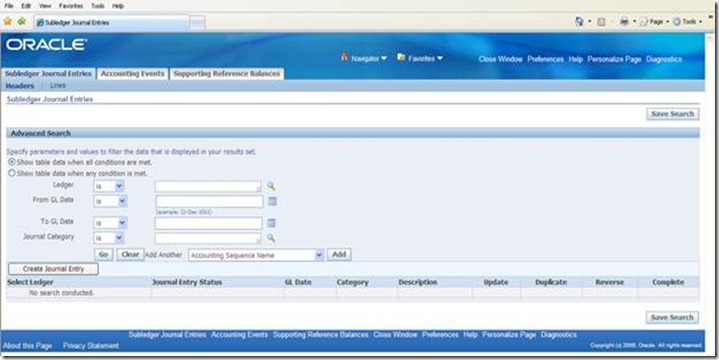

Subledger journal entry

Click Create Journal Entry

Enter Debit

Enter credit

Click continue

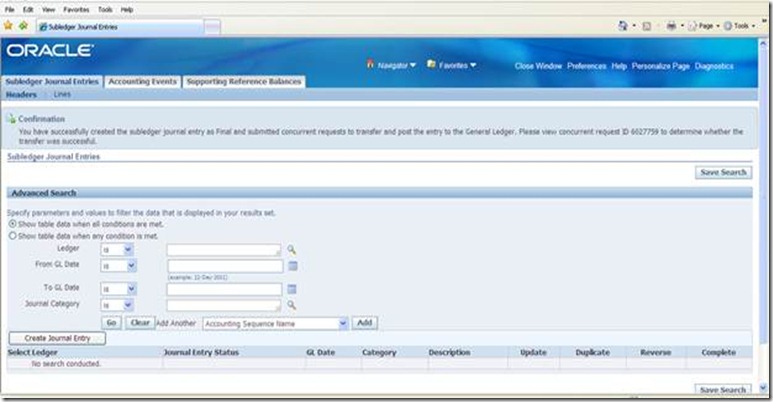

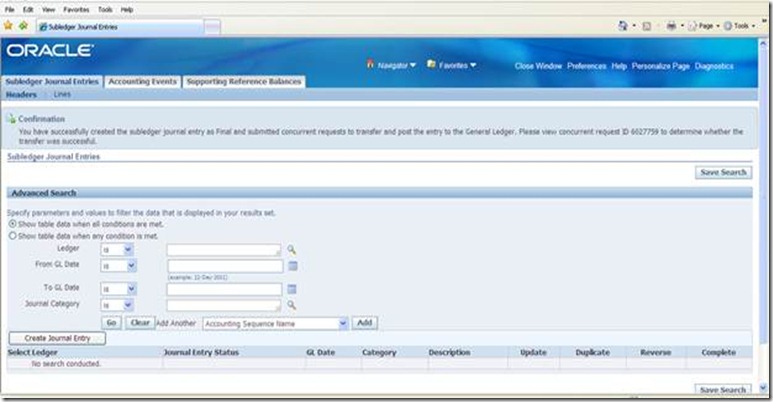

Select Final and Post and click finish button

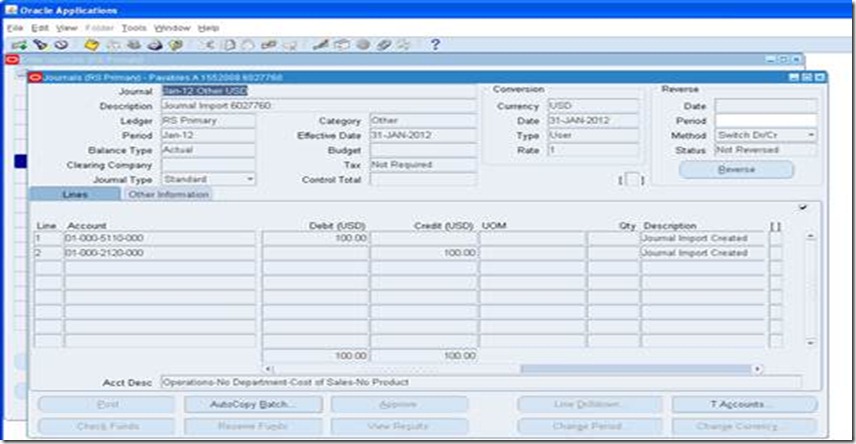

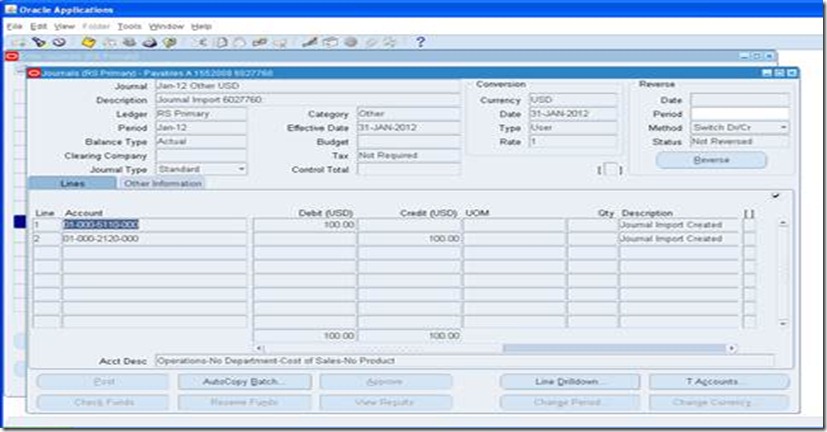

Result

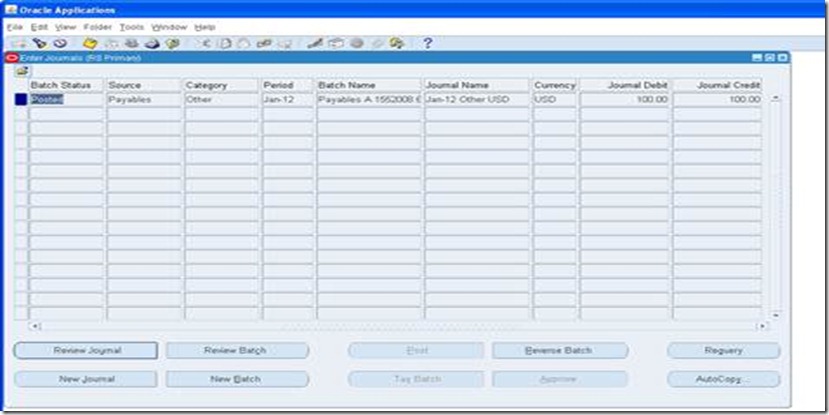

System should fire journal import

Go and check in payables whether any invoice (transaction) created

Go to GL and check the result

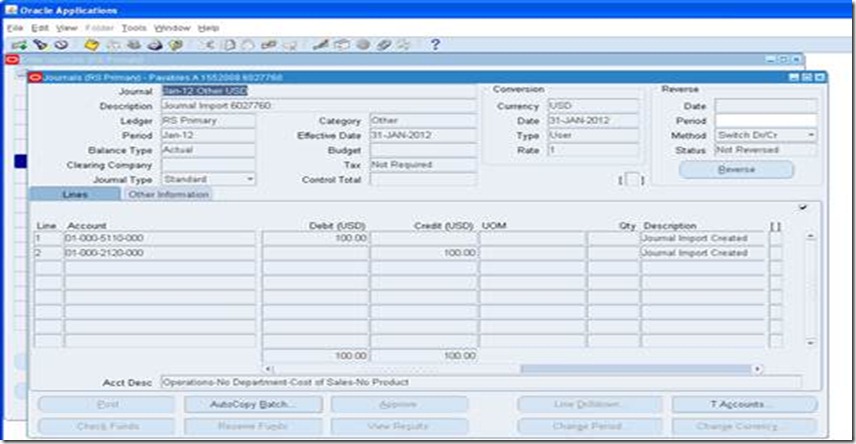

Note the Category, which is other.

Review the journal

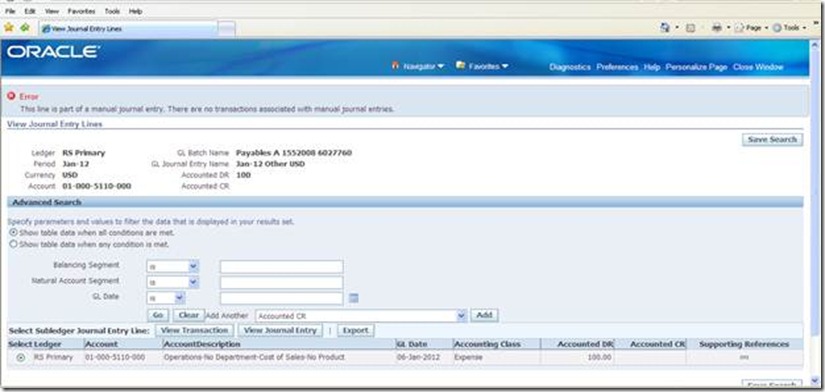

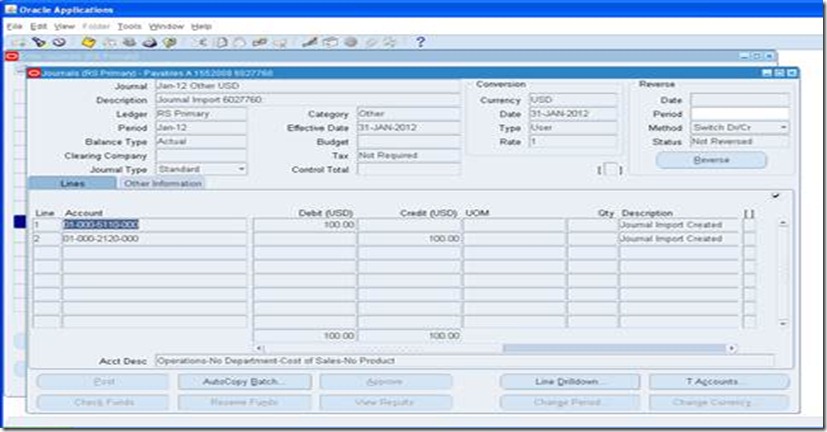

Click Line Drill down button

Click view transaction

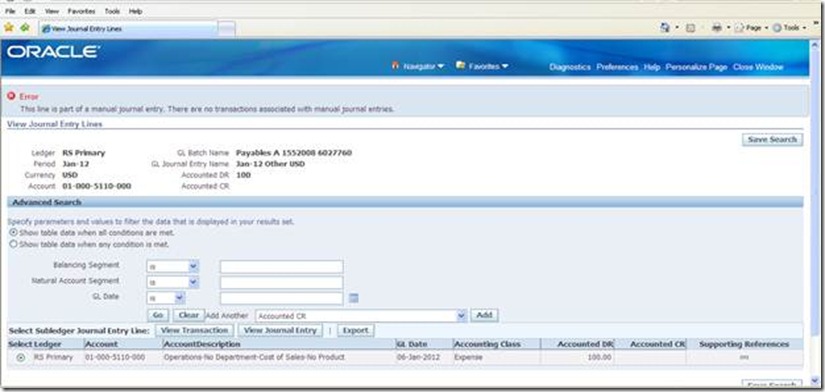

Read the error message, which confirms that no transaction has been created in subledger.

There is a new functionality to enter subledger journals through SLA: Create Journal Entry page.

Add the function SLA: Create Subledger Journal Entry, if not available in relevant module. All the modules by default will have this function unless specifically restricted.

Very important point is manual subledger journal entry is not associated with transaction of any subledger application. Meaning we can’t transfer the entries to both Subledgers and GL without customization. This is true whether we use FAH or DRM (Data Relationship Management, which is part of Hyperion) applications.

If required to use Manual SLA Journals functionality to represent accounting treatment in legacy systems, one can use API which allows importing legacy transactions into SLA, change the accounting treatment as per Oracle EBS logic or combination and then transfer to GL.

SLA is a rule based accounting engine not a module, which sits in between Subledgers and GL. The entry that appears in SLA can be controlled or design using SLA rules. Therefore it is known as Rule based accounting engine.

Don’t use SLA: Debug% profile option, which is obsolete. Instead use profile options FND: Debug% for SLA to debug.

To transfer the subledger journal entries to GL from subledgers run the following programs

- Create Accounting

- Run Transfer Journal Entries to GL – conditionally required.

Very important this is the functionality of FAH where we will use API XLA_JOURNAL_ENTRIES_PUB_PKG to load the data into this create journal entry page (see the screen shot below). We don’t need license of FAH to use this package, however.

This is another way of loading the journal entries apart from GL_INTERFACE, Web ADI or manually entering the journals.

This is particularly useful to stream line the accounting string between Oracle EBS and Legacy or third party systems, which is the basic of FAH.

How it works:

Go to Payable Module (any module can be used)

Subledger journal entry

Click Create Journal Entry

Enter Debit

Enter credit

Click continue

Select Final and Post and click finish button

Result

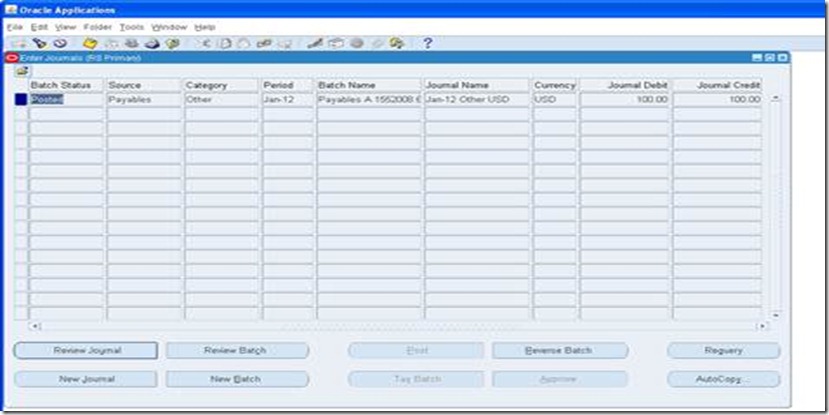

System should fire journal import

Go and check in payables whether any invoice (transaction) created

Go to GL and check the result

Note the Category, which is other.

Review the journal

Click Line Drill down button

Click view transaction

Read the error message, which confirms that no transaction has been created in subledger.